2022 Year in review

Marked by geopolitical conflicts and rising inflation, the global economy in 2022 took a hit. The turbulence in global economies caused by these factors coupled with the massive tech layoffs have affected financial markets. According to a report by Mckinsey, the number of successful global IPOs dropped by about 50% in the first half of 2022 compared with 2021.

This article will give a review of the start-up fundraising year in 2022, taking into account the amounts raised each month and compare them to give a broader view of how fundraising activities occured throughout the year and whether there were factors that affected the figures. It will also delve into December fundraising activities, give analysis and the full list of start-ups that received funding.

Start-up fundraising in 2022

This report is made according to data collected and analysed from the Skopai platform.

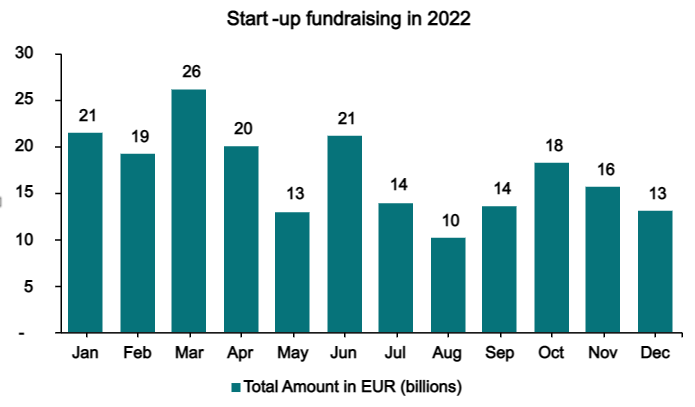

The graph below shows start-up fundraising activities from January to December 2022.

March recorded the highest total amount raised this year in fundraising events, recording €26B. May, August and December recorded the lowest fundraising amounts; €13B, €10B and, €13B respectively.

January and June had a significant increase in funds, having raised (€21B) representing the second highest funding months.

April (€20B), followed by February (€19B) and October (€18B) were the other significant funding months.

To have a close-up analysis of the events of the last quarter of 2022, click on the links below:

September *** October *** November

A snapshot of fundraising events and analytics in December 2022

The number of start-ups who received funding this month have decreased. 224 start-ups received funding as compared to November where 325 start-ups received funding.

To see the full list of start-ups that received funding in December, click on the link:

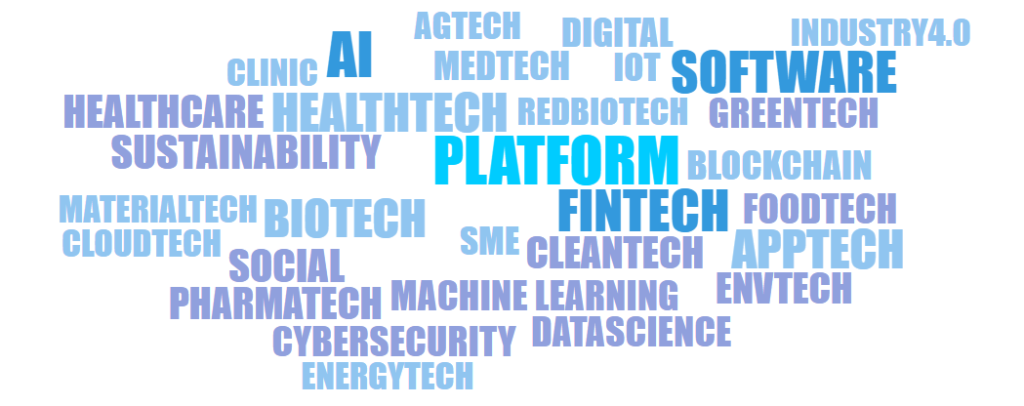

The word cloud represents the markets and technologies of start-ups that received funding in this month. Tags such as Software, Platform, AI and Fintech appear dominant giving us insight into which markets saw a lot of activities.

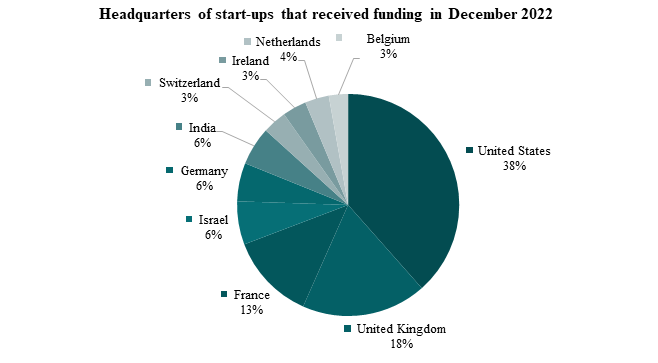

Distribution of start-ups that received funding according to their country of headquarter

According to the distribution of start-ups by their country of headquarter, the US is the country with the most start-ups that received funding followed by the UK, France, Israel, Germany, India, Switzerland, Ireland, Netherlands and Belgium.

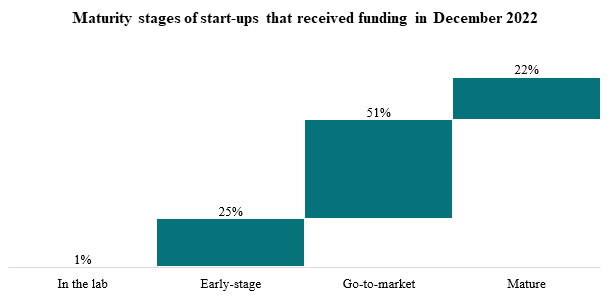

Maturity

By their maturity, most start-ups are on the go-to-market stage, followed by early-stage ventures. The go-to-market stage is an attractive stage for investors since the product is ready for commercialization after the research and development process. Furthermore, 77 funded start-ups have patents.

Funding rounds in December 2022

Per data analysed on the Skopai platform, start-ups received funding across different funding rounds ranging from Pre-seed to Series D rounds.

📌 Note that, all amounts are quoted in Euros on the Skopai platform for comparison reasons.

Pre seed

Melon: Is a London-based start-up that provides upskilling tuition packaged as a social media-style feed that curates relevant content.

Fundraising: Melon raised €1.4M in a Pre-Seed round and intends to use the funds to launch a recruitment drive, while also building on its software platform and outreach activities.

Seed round

Everimpact: Is a French climate tech start-up that provides a carbon Monitoring, Reporting, and Verification (MRV) platform allowing cities and organisations measure GHG emissions accurately and in real time, thanks to satellite, ground sensors, and AI data.

Fundraising: Having raised €1.7M in Seed funding, it intends to use the capital to expand carbon monitoring and monetisation capabilities in cities at a global level.

Infinimmune: Is a US-based biotechnology start-up that developed a range of products in immunology, single-cell technologies, protein engineering, computational biology, and genome assembly.

Fundraising: It raised an amount of €11.48M in a Seed round and will use the fresh fund to expand its team of talent, develop R&D capabilities, and scale operations

Series A

Giraffe360: Is a Latvian subscription based proptech start-up that has developed a 3-in-1 virtual tour camera for real estate agents. It creates HDR photography, virtual tours and floor plans with 98% accuracy.

Fundraising: Giraffe360 raised €15.31M in a Series A round and will use the fund in conjunction with their new camera (Giraffe Go Cam) to transition toward more immersive experiences of properties online

RepAir Carbon Capture: Is an Israeli start-up that developed an electrochemical device designed for utilizing electricity to separate CO₂ from the air.

Fundraising: It raised €9.57M in a Series A round and intends to use the funds to expand operations and its development efforts.

Series B

Intello Labs: Is an Indian start-up offering a complete automation in the supply chain management of agri-commodities and deploys image recognition based tools for the quality assessment of fruits and vegetables.

Fundraising: Intello Labs raised €2.87M in a Series B round which would be used to meet immediate working capital and long-term funding requirements for the business.

Storm Therapeutics: Is a British start-up that developed RNA epigenetics for tackling disease through modulating RNA modifying enzymes.

Fundraising: Storm Therapeutics raised €28.7M in a Series B round. The funds will be used to advance its clinical program targeting METTL3 for the treatment of solid tumors and leukaemias.

Series C

Drata: Is a US-based compliance and security automation provider.

Fundraising: Drata raised €191.31M in a Series C round and plans to use the money for R&D purposes.

Mews: Is a British cloud-based software company that provides property management products and services to the hospitality industry.

Fundraising: Mews raised €176.97M in a Series C round and intends to use the investment to accelerate product innovation, global expansion and consolidation through its Mews Ventures arm.

Series D

NotCo: Is a Chilean food-tech company producing plant-based alternatives to animal-based food products.

Fundraising: NotCo raised €66.96M in a Series D round and will use the funds to expand their AI-platform to wider industry and exponentially accelerate the transformation of the plant-based industry.

ZincFive: Is a Portland, OR-based provider of nickel-zinc battery-based solutions.

Fundraising: ZincFive raised €51.65M in a Series D round and intends to use the funds to accelerate its penetration into existing markets including mission-critical applications in data centers and intelligent transportation.

To see the full list of start-ups that received funding in December, click on the link:

Make more analysis using the events view tab to keep up with the funding activities of your favourite start-ups on the Skopai platform. You can also book a demo with our experts now to discover the Skopai platform.

We are looking forward to the financial year in 2023, new technology releases and fundraising activities. If you like articles like these, be sure to follow our socials to not miss any of our monthly fundraising news articles.