This year has been a momentous one. Spanning from politics to the economy, to technology. 2023 has seen many highs and lows. Simultaneously, the fundraising space and the start-up ecosystem have witnessed many events. Some months saw a surge in funding than others. In this article, we will review the 2023 start-up fundraising year using data collected from the Skopai platform.

Table of contents

Monthly Fundraising Analysis

The years 2021 and 2022 have been marked according to Mckinsey, March 2023, as the first and second best fundraising and most active deal making years on record. Although in the second half of 2022, deals started plummeting and have been predicted to contue through to 2023. 2023 has indeed being a slower year despite the growing importance of AI projects and Greentech projects.

Total amount raised by start-ups and number of events recorded

🟢Total amount of funds raised: € 134.5 Billion

🟢Total number of events: 2,948

Out of 2,948 events recorded, €134.5 Billion was raised by start-ups over the world.

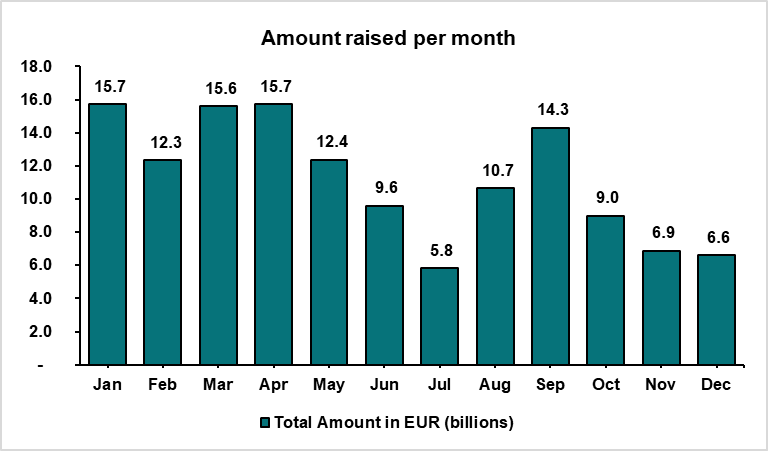

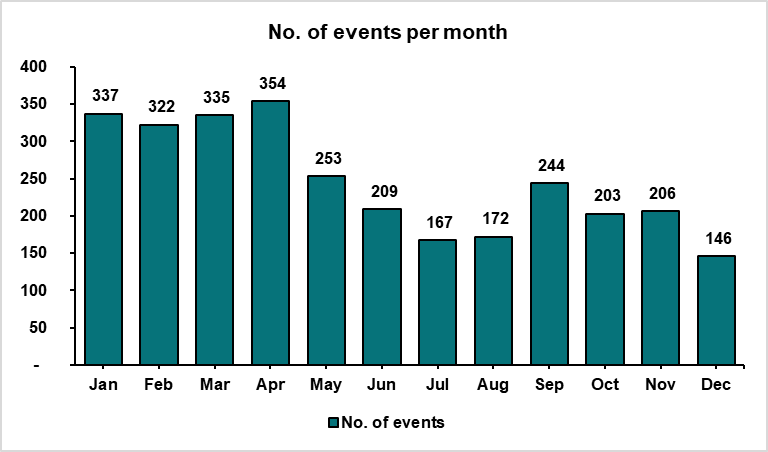

January and April recorded the highest fundraising totals with each raising €15.7 Billion. April however had the most events of the year. March followed strongly securing €15.6 Billion in funds. Similar to 2022, 2023 also had a year of two halves, with buoyancy in the first half and plummeting deal and event volumes, and fundraisings in the second half. September suprisingly pulled a number, with total amount of funds raised at €14.3 Billion. July recorded the lowest amount of funds raised at €5.8 Billion.

Fundraising per country

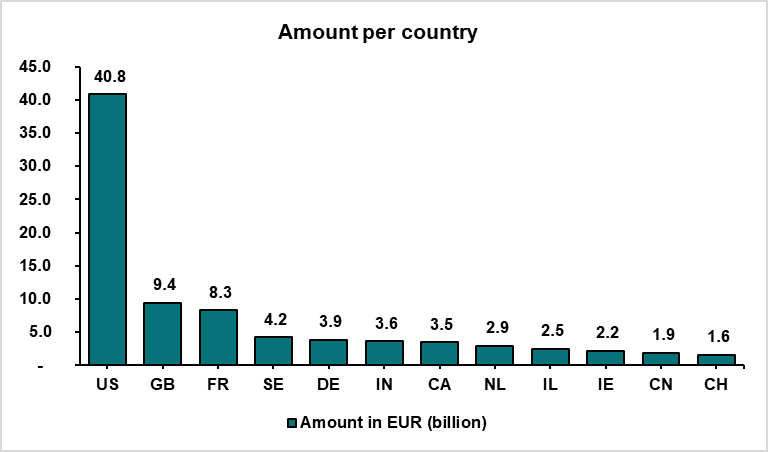

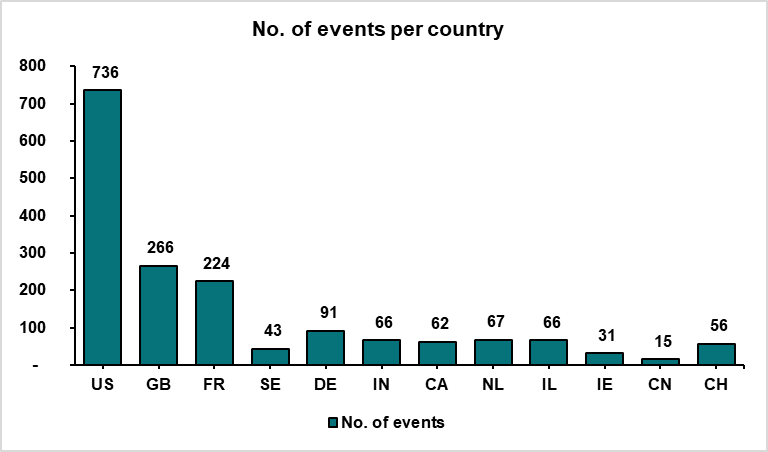

With 736 events, the USA raised the highest funds with €40.8 Billion, followed by the UK with €9.4 Billion. French start-ups secured €8.3 Billion in funds, and Sweden in tow with €4.2 Billion, Germany (€3.9 Billion), India (€3.6 Billion), Canada (€3.5 Billion), Netherlands (€2.9 Billion), Isreal (€2.5 Billion), Ireland (€2.2 Billion), China (€1.9 Billion) and Switzerland (€1.6 Billion).

Industry-Specific Transaction Insights and Maturity Stage Analysis

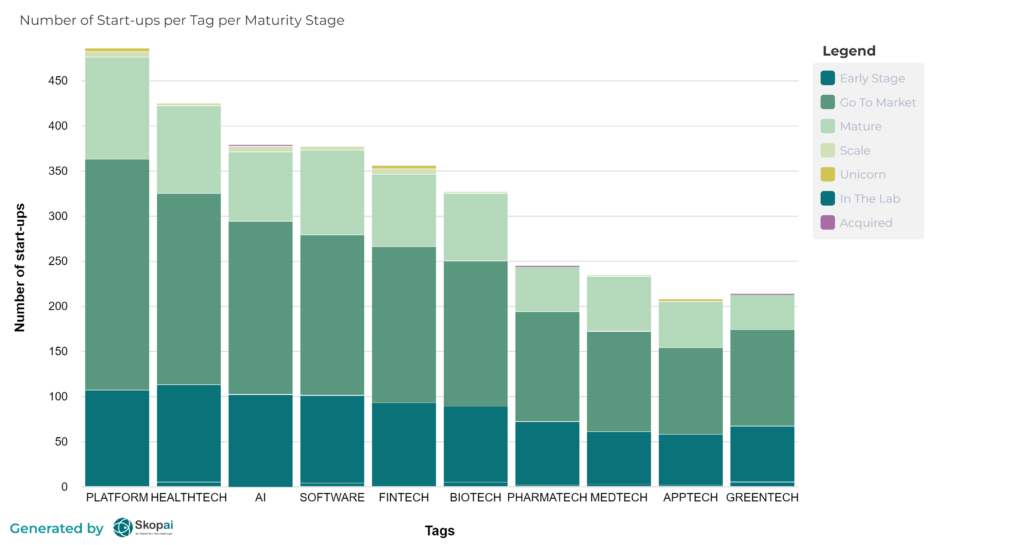

Despite the significant influence of Generative AI and the growing AI projects observed throughout the year, one will expect AI business models to lead the charts but instead, Platform business models dominated as investors showed more interest for start-ups following this model.

There was a notable increase in fundraising for Biotech start-ups this year. The current drive towards implementing ESG (Environmental, Social, and Governance) initiatives is directing a shift in attention and interest towards sustainable projects.

Amidst these developments, the go-to-market stage continues to be an attractive stage for investors, given that products are ready for commercialization after the research and development process. This dominance spans across various sectors, creating a consistent trend in investment preferences. The early and mature stages tend to fluctuate depending on the specific industry in question.

The 2024 fundraising year just began and, though it remains uncertain, it is exciting to look forward to all the events of the financial markets and the start-up space.

The insights in this article are provided by the Skopai platform, an AI powered platform providing insights into start-ups and scale-ups worldwide to help decision makers like VCs, PEs, government organisations, business directors discover start-ups for investment purposes as well as universities and R&D teams who need to collaborate with start-ups for open innovation programmes. By offering precise research, up-to-date information, and a vast network of start-ups, Skopai empowers businesses to make well-informed decisions, foster collaborations, and thrive in the fast-paced world of start-ups. Book a demo with our experts now to see how the platform can help you make data driven decisions or plan for your next open innovation programme.