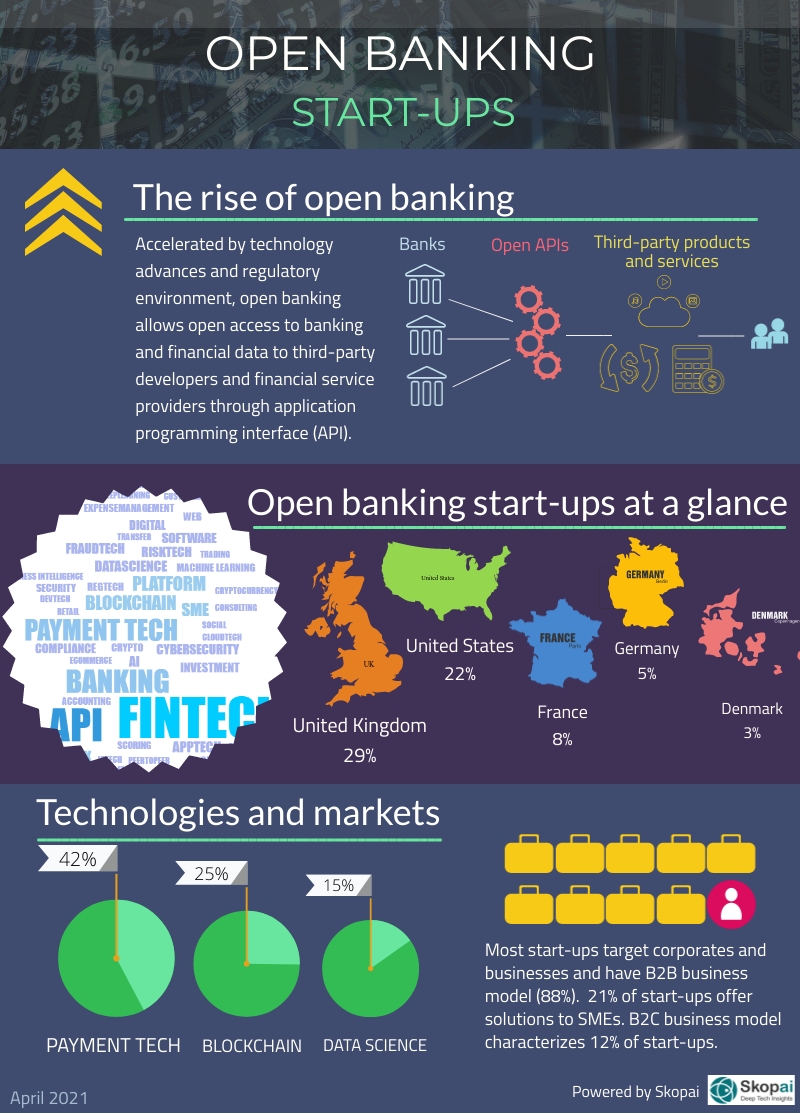

Skopai analyzed open banking startups with a focus on their technologies and markets. Open banking allows financial institutions and other third parties accessing bank data and offer innovative and personalized fintech solutions. These start-ups create new technologies and innovations to better manage financial data, payments, budgeting, and investing, as well as to improve customer experience.

Observing the locations of the analyzed open banking startups shows that the start-ups from the United Kingdom (29%) and the United States (23%) dominate the landscape. Other countries, such as France, Germany, and Denmark, also produce breakthrough technological innovations in open banking. Focusing on technologies and markets allowed identification of the dominant technologies used by the open banking start-ups, which include payment tech, blockchain, and data science. Business-to-business solutions dominate the open banking landscape.